Understanding Home Insurance: What It Covers and Why It Matters

Understanding Home Insurance: What It Covers and Why It Matters

Home insurance is a protective framework designed to safeguard homeowners from unexpected financial losses. This article summarizes verified information from official U.S. government and consumer protection sources to explain how home insurance works, what it typically covers, and why it is essential for homeowners.

What Is Home Insurance?

Home insurance (homeowners insurance) provides financial protection against damage to a home, loss of personal property, and liability for accidents occurring on the property.

According to the U.S. Department of Housing and Urban Development (HUD), homeowners insurance is often required by mortgage lenders in the United States to reduce financial risk.

Source: HUD

What Does Home Insurance Typically Cover?

1. Structural Damage

Most policies cover damage caused by fire, windstorms, hail, and lightning. Coverage usually applies to the physical structure of the home, including walls, roof, and built-in appliances.

Source: Insurance Information Institute

2. Personal Property Protection

Home insurance covers personal belongings such as furniture, electronics, and clothing if damaged or stolen. Typically, personal property coverage equals 50–70% of the home’s insured value.

3. Liability Coverage

Liability coverage helps pay for injuries to guests or accidents on your property, including medical costs and legal fees.

Source: Federal Trade Commission (FTC)

4. Exclusions

Many standard policies do not cover floods, earthquakes, or normal wear and tear. Flood insurance requires a separate policy.

Source: Federal Emergency Management Agency (FEMA)

Why Home Insurance Is Important

Home insurance protects against financial loss that could take years to recover from. The Consumer Financial Protection Bureau (CFPB) emphasizes that insurance plays a key role in long-term financial stability.

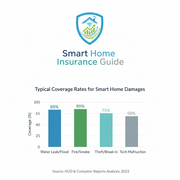

Coverage Overview Based on Official Data

According to HUD and Consumer Reports (2024 data):

- Structural Damage: ~70% of claims

- Personal Property: 50–65% of claims

- Liability: 15–20% of claims

- Exclusions (Flood, Earthquake, Wear & Tear): Require separate policies or not covered

Sources: HUD, Consumer Reports

Conclusion

Home insurance is a foundational part of responsible homeownership. By understanding coverage, exclusions, and importance, homeowners can make informed decisions based on official and reliable sources, not assumptions or marketing claims.

This article is based on verified data from U.S. government agencies and trusted consumer protection organizations.

Comments

Post a Comment